What is Making Tax Digital About?

Each year in the UK, the Exchequer loses over £9 billion a year due to avoidable tax mistakes. While the vast majority of HMRC customers try to make sure and indeed do pay the correct taxes, the process isn’t always as simple as it could be which leads to costly, inadvertent errors.

From 1st April this year, the Making Tax Digital (MTD) strategy will be introduced in pursuit of HMRC’s aim to become one of the most digitally advanced tax administrations in the world, transforming processes to become more effective, efficient and easier for taxpayers to use correctly.

Initially this will mean that qualifying VAT-registered businesses will be required to ensure that all records and VAT returns are kept and submitted digitally to HMRC. Later this year, this will be expanded to include smaller businesses as well.

Many, if not the majority of companies already keep records and accounts digitally, thanks to the advantages that digitisation has brought throughout the business. However, the main differences under MTD are that the software used must be capable of:

- Holding the records specified in the regulations

- Using those digital records to prepare VAT Returns

- Communicate information with HMRC via their API platform

Digital records and returns are to be stored and transferred digitally using “functional compatible software”, defined as:

A software program, or set of software programs, products or applications, that must be able to:

- Keep and maintain the records specified in the regulations, preparing VAT Returns using the information maintained in those digital records

- Provide information to and receive information from HMRC, by communicating digitally via the API platform

Although a complete set of records must be held digitally, the information doesn’t all need to be contained in one place – a combination of software packages, as well as spreadsheets, can be used provided that together, they encompass the full set of records.

Remember though, when transferring data between any of the combined solutions, to reduce the risk of erroneous entry that data transfer must also be completed digitally.

Communicating Records via Digital Links

The majority of errors that appear in VAT returns are nothing malicious, but are simply the result of a simple mistake in data entry. Especially when copying data from one place to another, any person can become susceptible to the monotony of the task and inadvertently make a mistake.

The requirement to ensure all records are transferred digitally is designed to minimise the risk of errors caused by manual data entry, as well as reducing the time, resources and costs involved for businesses when submitting information manually.

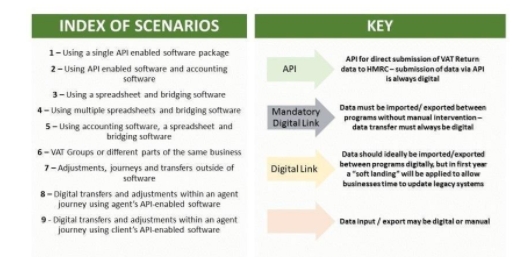

Depending on the scenario, there are three acceptable ways of transferring records digitally:

- Using APIs – the required method when submitting data to HMRC

- Using a “Digital Link” – leveraging import/export functions with no manual intervention

- Manual Data Input – acceptable only for agents entering adjustments to returns

The following diagram from HMRC provides more detail on data transfer scenarios and their requirements under MTD:

Leveraging SAP to Support MTD Requirements

For the many businesses already using SAP financial systems to maintain digital records, as there are no requirements in MTD to collect and store any additional information for VAT, the key difference will be how those records are communicated with HMRC.

To make meeting the new MTD requirements as simple as possible, SAP have worked with HMRC to create functionality within the SAP Advanced Compliance Reporting Service, delivered through the SAP Localisation Hub, to generate tax computations and submit returns in accordance with MTD.

The SAP ACR Service is built on SAP Cloud Platform and delivered as a SaaS solution, providing pre-packaged support for MTD requirements and a central framework for compliance reporting. The service is easily configured to connect securely with HMRC via their API platform to seamlessly submit returns and receive receipts.

Users of SAP ECC will find that all required tax details located in SAP ECC are imported into the ACR Service through digital links, enabling preparation and generation of tax returns in line with MTD before providing review and submission processes. With secure API connectivity enabled, returns are quick to submit and confirmation receipts are received instantly.

Users of SAP S/4HANA will find the process streamlined even further, with all steps to prepare, generate, review and submit covered within the SAP S/4HANA Advanced Compliance Reporting solution (Note: While also named ACR, this is different to the solution available in the Localisation Hub).

Whichever method is appropriate, the SAP ACR solution provides full audit trails and traceability with HMRC Digital Tax Accounts.

For more guidance on getting ready for Making Tax Digital, contact us today.